What If Mystery Was the Product Itself? Inside Wang Ning’s Pop Mart Empire

Wang Ning still remembers how a foil-wrapped doll changed his life. It was 2010, and the recent graduate was minding a narrow stall in a Beijing mall when he noticed the way customers paused before tearing open tiny Japanese Sonny Angel figurines. Their fingers hovered, their faces lit up, and then they hurried back for another try. That moment, he later told China Daily, revealed a business hidden inside anticipation, surprise and delight.

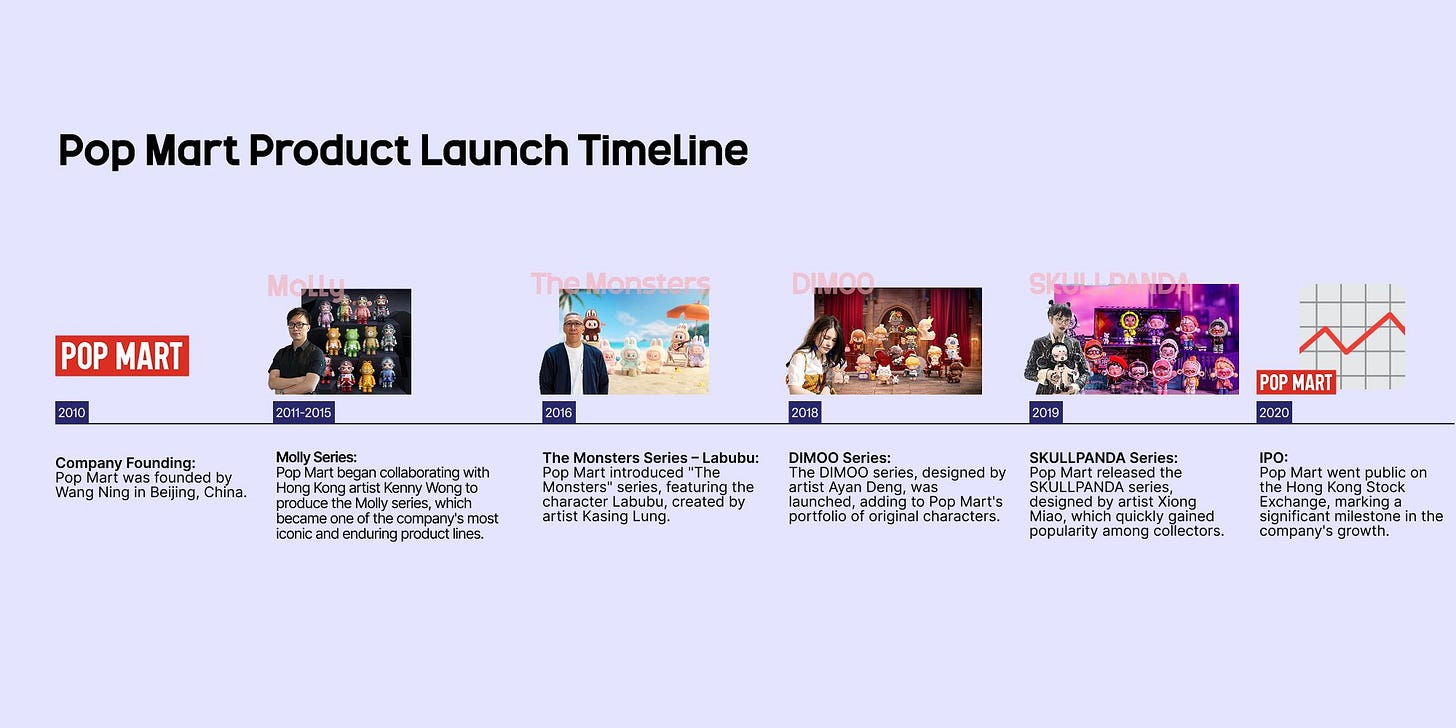

Five years on, Wang wagered everything on that insight. He rebranded his fledgling shop as Pop Mart, licensed Hong-Kong artist Kenny Wong’s wide-eyed Molly, and—crucially—sealed every doll in an opaque “blind box.” Industry friends thought the idea reckless; Wang called it a new toy category. The bet worked. By 2019 Molly alone supplied roughly a quarter of group revenue, and Pop Mart’s future would hinge on keeping that magic of uncertainty alive.

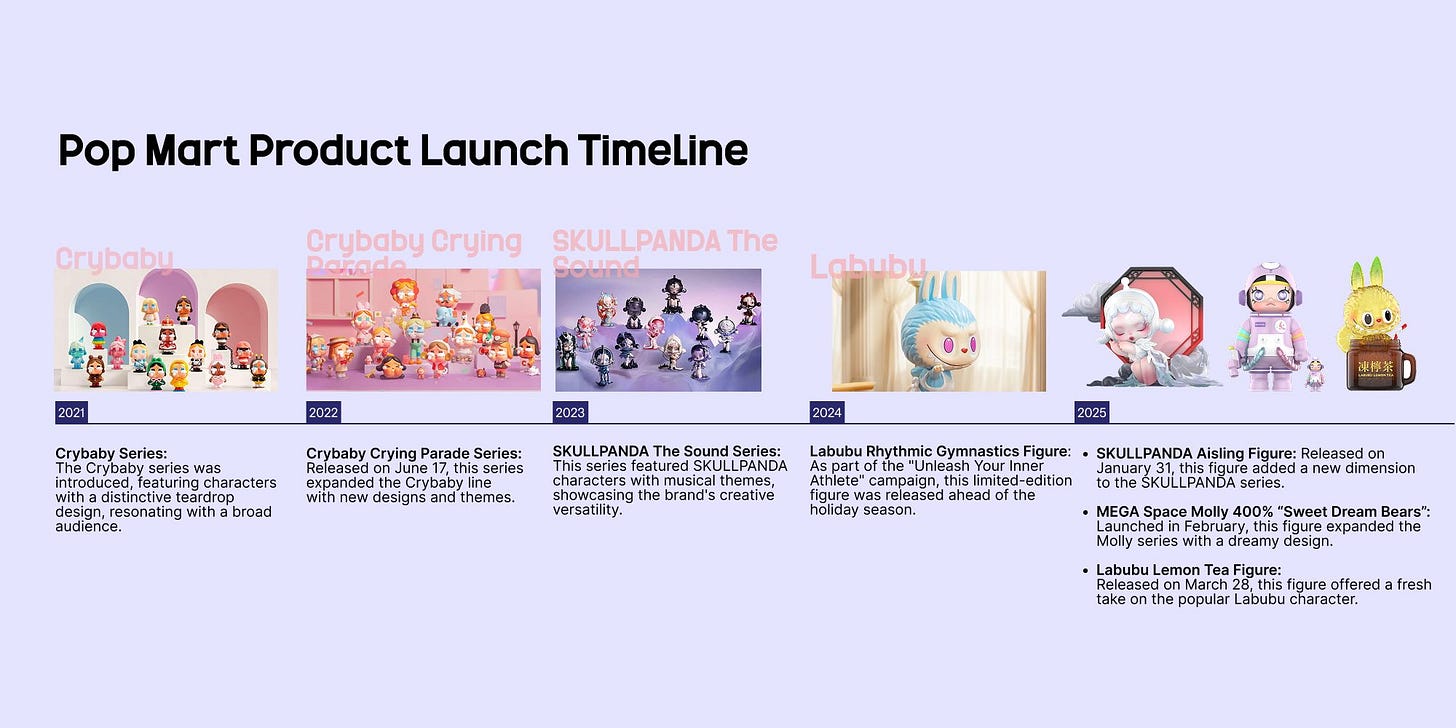

New characters followed in quick succession. Skullpanda, a pastel-punk outsider, leapt past the one-billion-yuan sales mark with its “Temperature” series. Labubu, a mischievous bunny-badger from The Monsters universe, caused such a frenzy in Bangkok in 2024 that seventy percent of the store’s launch inventory vanished during opening week.

Crybaby, all drooping eyes and meme-ready melancholy, raced into the billion-yuan club faster than any earlier line and now appears on fashion mood boards alongside Jellycats. Last year Pop Mart said that proprietary characters—including these four—accounted for roughly sixty-five percent of sales, proof that owning the intellectual-property outright can be more lucrative than renting a famous brand.

Fans—from casual collectors to global celebrities—power virtually all of Pop Mart’s marketing. Mainland China alone counts forty-six million loyalty-club members, and each new series shrouds a one-in-144 “secret edition.” Collectors livestream midnight unboxings outside the brand’s 2 300 Roboshops—vending machines glowing like sci-fi lockers in mall foyers. Among them is Blackpink’s Lisa, whose blind-box obsession began earlier this year when a Thai friend urged her to try Molly and Labubu figures; “Once I got them, I went crazy. I spent all my money!” she laughed. In a Vanity Fair video that has amassed over 610 000 views, Lisa fan-ed over rare characters— calling each reveal “yin and yang” excitement—and named Zimomo and Labubu as her favorites. Within hours of the clip’s release, Pop Mart’s online store saw record traffic spikes and instant sell-outs. Because devotees like these generate the buzz, Pop Mart spends a fraction of the ad budgets of legacy toy makers yet sustains a gross margin of about sixty-three percent.

The numbers behind the thrill are now impossible to ignore. In 2024 revenue more than doubled to 13.04 billion yuan and net profit jumped to 3.13 billion. Pop Mart ended the year with 401 branded stores on the Chinese mainland and another 120 in Hong Kong, Macao, Taiwan and overseas—a total of 521. It also disclosed 5.07 billion yuan in overseas sales, nearly thirty-nine percent of the top line, up from less than ten percent just two years earlier. The fastest growth came from Southeast Asia, where Labubu queues in Bangkok and Singapore stretched into the street, but Europe got its own Oxford-Street flagship, and American outlets have multiplied from one Los Angeles pop-up to roughly twenty, with fifty targeted by the end of next year.

Investors have ridden the same roller-coaster as collectors. Pop Mart’s Hong Kong IPO in December 2020 priced at HK$38.50 and surged almost eighty percent on day one, only to slump during China’s long pandemic lockdowns. Then, as overseas demand caught fire, the shares rocketed three-hundred-and-seventy percent in 2024, turning Pop Mart into one of the hottest consumer stocks on the planet.

Wang insists the company is more than a lucky lottery ticket. “We are not a blind-box company,” he told an interviewer in 2023. “We sell joy.” Still, regulators have noticed the fine line between joy and addiction. A 2021 investigation highlighted scams and called for clearer odds disclosure; officials continue to debate caps on blind-box pricing. Analysts, meanwhile, warn of fad fatigue: if Gen-Z shoppers tire of Labubu variants, the next icon must be ready on deck.

For now, Pop Mart’s playbook looks repeatable: pair an artist with a fresh design, wrap it in mystery, and let millions of fans do the promotion. Wang says the long-term goal is to make Pop Mart “the world’s Pop Mart,” with overseas sales matching those at home. Whether he reaches Disney-scale or not, the echo of that first “aha” moment still rings every time a cardboard cube thuds into a vending-machine tray and a collector holds their breath.